Satshow 2023 is a gathering of service providers, equipment suppliers, technology wizards and a reunion of the many people involved in satellite communication. Held once again in the Washington Convention Center, the show runs four days long: Monday dedicated to lectures and an exhibit hall open Tuesday through Thursday, with speakers continuing alongside.

Amazon Project Kuiper (Dave Limp)

Dave Limp is Senior Vice President, Devices & Services. He has responsibility for things like Alexa, Kindle and FireTV, and also Project Kuiper. Here is Dave holding a Kindle alongside the smallest Kuiper user terminal which he literally revealed at the show.

There are three antennas:

- Enterprise (Gbps, 19"x30", more expensive)

- Residential (400 Mbps, 11"x11", $400)

- Compact (100 Mbps, 7"x7", lower cost than residential)

The enterprise antenna is apparently side-by-side, full duplex, with one transmit aperture and one receive aperture. The residential and compact operate over a single aperture - probably simplex (transmit or receive).

Project Kuiper customer terminals are powered by an Amazon-designed ASIC baseband chip, developed under the code name “Prometheus.” Limp refers to Prometheus as their "pixie dust".

From a digital signal, a modulator creates a waveform. The waveform has to be distributed to an array of elements, apply beamforming adjustments (phase shift or true-time-delay), upconvert to RF frequency, amplify and connect to each antenna element. Each element is managed independently. The same is in recieve, but the signal is downconverted, sampled (digital to analog), and combined into a composite using another set beamforming adjustments. Prometheus seems to include the modem, the beamforming, the up/down converters and amplifiers. Limp declared that by creating the Prometheus chip they have reduced cost by 10x from off-the-shelf alternatives and 10x the performance. Amazon assumes a market of 10+ million terminals.

Kuiper is a constellation of over 3000 satellites operating in LEO using Ka uplinks and downlinks. This has allowed Prometheus to be applied in the ground segment, not just the remote terminals.

Kuiper is set to launch two satellites in May, 2023. Limp expects that service coverage will be spotty based on latitude until service entry in 2026, with about one-half of the constellation in-orbit. Limp expects application beta testing to begin in 2024. A global licensing campaign is underway.

There are 77 medium-heavy lifts scheduled using Ariane, Vulcan and New Glenn.

Global Constellation Executive Roundtable

Mark Holmes moderated.

Nobody felt enough was being done to address sustainability in space.

Someone mentioned the concern over what revenue and profit margin come from serving those without internet access.

Eva Berneke is CEO of Eutelsat. Demand double-digit growth. Floodgates open when satcom can compete with terrestrial networks. Investment in OneWeb establishes multi-orbit service with existing GEO satellites. LEO has significant latency benefit. Software-defined equipment, flexible satellites driving down cost and speeding time-to-market. Looking towards Gen 2 OneWeb. Government and sovereignty issues are growing, especially watching events in Ukraine. Consumer doesn't care GEO Vs. LEO. Direct-to-Device and consumer broadband are huge markets. Already have telco partners. Starlink is a household name. US forcing 5-year deorbit Vs 25-year address sustainability - Europe needs to drive same.

Mark Dankberg is Chairman of the Board and Executive Chairman of Viasat, Inc. He co-founded the Company in 1986. Growth is in security and serving sovereignty. Much of the unserved demand is actually in metropolitan areas, not rural. Worries about LEO addressing concentrated demand. Watching LEO with interest. Worried about NGSO excessive supply and how interference will drive down efficiency when more than one constellation is in-service. Very concerned over sustainability, especially larger and larger LEO satellites. LEO has to consider landing rights (ground station) in-country to address national interests. Recognizes the benefit of lower latency achievable from LEO. Satcom pricing still needs to come down <I would argue Starlink is competitive>. It all comes down to spectrum. Internet usage CAGR is 20-30%. Service has to expand offering to maintain satisfaction while lower/holding price point. GEO broadcast (multicast, one to many) services are migrating to unicast (one to one).

Tim Ellis is CEO and co-founder of Relativity Space, an LA-based company that leverages patented additive manufacturing technology to 3D-print rockets in the world’s first autonomous rocket factory. Available medium to heavy launch capacity is limited through at least 2027. New launch vehicles have to demonstrate achievable cadance. Customer doesn't care LEO Vs GEO, they want the service to work. Starship is an inflection point for launch capacity.

David Kagan is CEO of Globalstar. Counts 14 devices attached to his home router; device count drives demand up from same number of users. Looks to IoT and complementing cellular for new markets. Apple emergency SOS brings big-tech into satcom (and Amazon with Kuiper). Provides credibility and accelerates innovation.

David C. Wajsgras is Chief Executive Officer of Intelsat. He looks to the large unserved population (the other 3-4 billion). He believes demand will keep pace with supply - new markets like agriculture, energy, mobility. 2022 was a good year for Intelsat and 2023 looks as promising. Using Eutelsat GEO/LEO (OneWeb) capacity in near-term is adequate. Looking to Mergers and Acquisition for their own LEO play (could they be investing into Telesat Lightspeed?). Satcom coming into the mainstream. Cybersecurity a huge concern for each nation.

Software Defined Modems, Antennas, and Satellites

Virtualization, digitization, disaggregation - everything revolves around software-defined functionality. First thing that caught my eye was this monument spinning around Blue Marble Communication's stand.

Was chatting with Joe Palovick from Astronics about their dual modem Modman. Seamless Air Alliance is working up a card-level standard for modems, which is more about packaging, thermal management, and edge-connector. Astronics can support three different modems, but each is unique. The next step is to go to a software-defined modem using a software-defined radio (SDR) as the core. Joe worries about SDR excessive power-consumption - as much as twice a dedicated card produces. This is a problem with the Modman limited to 100W and that is already tight with existing modems.

Orbit Tail-Mount Ka-Band Antenna

The market for tail-mount (or ugly fuselage mount) has another entrant. There is an 18" parabolic with G/T of 16.1 dB/K (receive) and 56 dBW EIRP & 42 dBW/MHz (transmit). Transmit and receive are independently controlled, circular polarized. It weighs 31.5 lbs.

This is the 12" version. It weighs about 22 lbs. I don't have a spec sheet.

The associated KPSU (power supply) weights 11 lbs and consumes 175 W off of 28 VDC (not shown).

Ball Ku-band Aero Antenna

Walked by the Ball stand and saw the large Stellar Blu Sidewinder on display that uses Ball components.

Sidewinder is being used by Intelsat for multi-orbit GEO and LEO (OneWeb) (Alaska Airlines). Sidewinder is also available to Panasonic Avionics.

Sidewinder comes in three sizes (ARINC 792, Multi-network, LEO).

Ball has used Anokiwave foundry phase-shifters in their sub-arrays. A true-time delay beamformer steers the sub-arrays.

CesiumAstro Ka-band Aero Antenna

CesiumAstro unveiled their aero-satcom terminal. Airbus is an investor on this project and plans to flight test it.

It was not apparent how many beams it can form, but it claims make-before-break, which would imply at least two receive beams.

The published spec sheet shows G/T for 12 dB/K for the 18"x18" Rx array; 15 dB/K for he 36"x36" Rx array. Thinkom achieves 18 dB/K with their 25" Rx antenna.

The Cesium array claims a scan range of 60 degrees. The ThinKom KA2517 is rated to over 80 degree scan range. 60 degree is fine for LEO, but will severely limit edge of coverage with GEO. I assume the idea is to use GEO only when favorably positioned and LEO on the edge-cases.

SatixFy Ku-band Aero Antenna

I will follow up with SatixFy for an update, but here was their antenna on display. I have some concerns about the "nostrils", presumably for airflow cooling.

I consider this antenna to be the most exciting on the market, with a pure digital beamformer. That provides the ability to have any number of beams without gain reduction (but there is bandwidth reduction).

Cassiopeia RIGEL Ku Luneburg-Lens Antenna

The RIGEL terminal is a competitor in the startup space. I listened to their "shark-tank" pitch.Mark Rayner was leading the Datron development and told me a funny story. He had shipped an antenna to a partner. When he arrived to demonstrate the antenna, he had to wait for it to be unpacked. After a long while, they reported that it was being brought in, that it took them a long time to remove the "styrofoam" packing on the aperture (which were the Luneburg lenses). Datron produced a Luneburg lens for DBS receive that I believe Panasonic and others had deployed. Just to say, Luneburg lenses have been around for decades.

RIGEL seems to have installed a clever pickup assembly that allows for multiple pickups or beams to be formed. As pictured, it looks like one big lens. That raises its profile. Datron had gone with multiple lenses and a combining network to reduce profile height. Datron had a mechanized pickup for each lens.

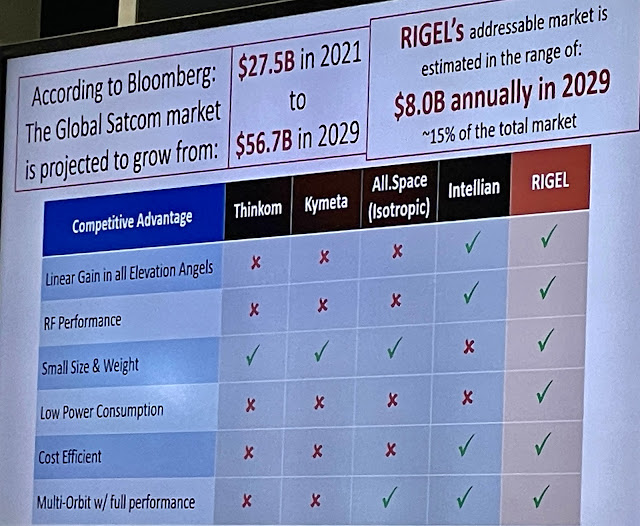

I was pretty frustrated with this chart that Casseopia put up.

Linear Gain in all directions - the issue is a flat panel antenna Vs a full size profile. You don't get both low profile and linear gain. Low profile usually wins (at least, for aero) and scan loss can be offset by increasing the flat-panel aperture size.

I have no idea what RF performance refers to, but VICTS (ThinKom) is a passive technology with better efficiency than the active or lossy apertures. RIGEL claims 70% efficient (this is mostly about receive). There is no data sheet published and they are just now in the lab. Pretty bold claims!

Low Power Consumption. VICTS is a passive antenna. Their 30" aperture only use about 35 Watts of power. The big power is in their single-ended high power amplifier. I assume the RIGEL antenna uses a similar high power amplifier, so why are they lower power than Thinkom? I think Kymeta is also pretty low power, but probably a bit more than VICTS.

Cost efficient? Cost Vs Price is one aspect. Market-driven pricing also comes to mind. Aero qualified is another aspect. Low-profile is another issue, relating to fuel burn. I think it is hard to compare price without context or common framework.

Multi-orbit with full performance. I heard Cassiopeia state that dual-beam means half-the gain. That is true if you split the aperture. But a fully overlay beamforming array (two beamformers) can operate through a common set of elements. And digital beamforming can have any number of beams, all at full gain. In any case, Kymeta and ThinKom for sure can operate multi-orbit, but in one at a time, single beam.

Stay tuned!

Peter Lemme

peter @ satcom.guru

Copyright 2023 satcom.guru All Rights Reserved

Peter Lemme has been a leader in avionics engineering for 42 years. He offers independent consulting services largely focused on avionics and L, Ku, and Ka band satellite communications to aircraft. Peter chaired the SAE-ITC AEEC Ku/Ka-band satcom subcommittee for more than ten years, developing ARINC 791 and 792 characteristics, and continues as a member. He also contributes to the Network Infrastructure and Interfaces (NIS) subcommittee.

Peter was Boeing avionics supervisor for 767 and 747-400 data link recording, data link reporting, and satellite communications. He was an FAA designated engineering representative (DER) for ACARS, satellite communications, DFDAU, DFDR, ACMS and printers. Peter was lead engineer for Thrust Management System (757, 767, 747-400), also supervisor for satellite communications for 777, and was manager of terminal-area projects (GLS, MLS, enhanced vision).

An instrument-rated private pilot, single engine land and sea, Peter has enjoyed perspectives from both operating and designing airplanes. Hundreds of hours of flight test analysis and thousands of hours in simulators have given him an appreciation for the many aspects that drive aviation; whether tandem complexity, policy, human, or technical; and the difficulties and challenges to achieving success.

No comments:

Post a Comment